- Connect

- Locations

-

Contact & Support

- Getting Started

- Help Center

- Online Travel Notification

- Mailing Addresses

- Online Banking Balance & Activity Alerts

- Making a payment with Bill Pay

- Bill Pay Reminders & Alerts

- Bill Pay eBill

- What is the $5 Membership?

- Security Alerts

- Secure Email

- Card Controls

- Principal Only Payments

- Accessing the Bill Pay Legacy Site

- Financial Tools

- Redeeming Your GreenState Credit Card Points

- Contact Us

- Online Chat Support

- Staff Directory

- Fraud Prevention

- For Employers

- ¡Bienvenidos!

- Creating Lasting Value

- Personal Accounts

- Business Accounts

- Account Management

- Loans

- Credit Cards

- Business Loans & Services

- Wealth Management

- Trust Services

- Insurance

- Locations

- Contact & Support

- Creating Lasting Value

Credit Score

-

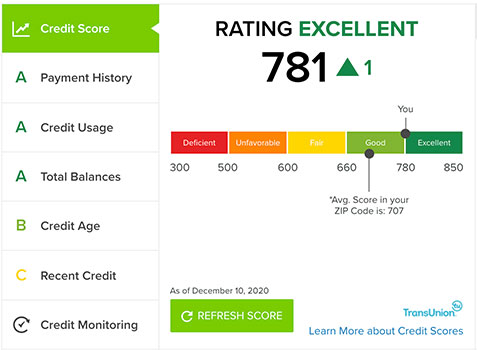

Check Your Credit Score Daily with SavvyMoney

Now you can track your credit score each time you login to Online Banking! With one click, you get daily credit score updates, credit monitoring, view a credit report and receive money saving offers. You can also understand your credit score, factors that impact it, and what you can do to improve it. It is just one of the ways that GreenState Credit Union is looking after your financial health.

To use this free service, simply login to Online Banking and click on Credit Score.

Get your Credit Score and learn about the factors that impact your score.

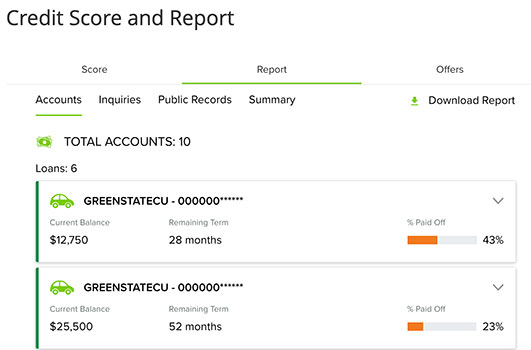

Review your Credit Report for open accounts and recent inquiries.

Explore financial education tips and articles.

Frequently Asked Questions

- What is this new feature?

It is a comprehensive credit score program (powered by SavvyMoney) that is now offered with GreenState Credit Union Online Banking. It helps members stay up to date and knowledgeable about their credit score. It also educates on ways to improve the score, and helps with fraud detection.

- Why is GreenState offering this?

Financial education is part of what GreenState provides members. We feel it is good for members to have a better understanding of their score and how it is derived.

- Do I have to "opt in" for this service?

Yes. It is optional, so you will need to opt in. Once logged into your GreenState Online Banking, click “Show My Score”, found on the right side of the page. Next, simply answer the questions, which include information regarding your credit history, and then you are all set. The next time you log into Online Banking, the portal will be available, showing your current credit score at a glance, as well as different offers for GreenState products.

- Is there a fee for this?

No. This is a free service.

- Why is it important for me to take care of my credit score?

Credit scores are used for many reasons. Not only can a good score secure loans at a better rate, but it is often checked when buying insurance, renting an apartment, and even applying for a job.

- If this feature is frequently providing updates on my credit score, will it damage my score with all those inquiries?

No. Checking your score through this service is considered a "soft inquiry", which does not affect your credit score.

- How can I learn ways to improve my credit score?

In the Score tab of the portal, you can look at the different criteria that make up your score. Here, you can click on each criterion to learn how to improve that portion which makes up your score. Under this tab is where you will also find your score history and more tips to improve your credit score.

The service also offers access to the “Your Money” blog, which includes an extensive array of financial education articles that may help you improve your own financial position. This blog can be found under the More tab. - How can this help with Fraud detection?

It allows for real time, daily credit report monitoring. You can see when the last time a credit report was pulled and gives you the ability to sign up for email alerts to notify you when there has been a change to your profile. To turn on these alerts, click the Credit Monitoring box under the Score tab.

- Will the Credit Union honor my SavvyMoney credit score for loan applications?

Yes, for retail products. While your SavvyMoney credit score may differ from the scores we get from the credit bureaus, our goal is to provide you with the best offer we can. If you SavvyMoney score is different than the score we have, simply print out your score and let us know. We will review your information and determine if there is a better offer we can provide you. Mortgage Loan applications require a separate credit pull so the SavvyMoney score cannot be used or matched for these loan products

- How can I dispute my credit score?

If you find your credit score or other information to be inaccurate, you can file a dispute with TransUnion directly through SavvyMoney. This can be found under the Report tab.

- Can I see a joint account holder’s information in this service?

The service pulls information from the Primary account holder only. A joint account holder may access their own profile by creating their own personal online banking login.