- Connect

- Locations

-

Contact & Support

- Getting Started

- Help Center

- Online Travel Notification

- Mailing Addresses

- Online Banking Balance & Activity Alerts

- Making a payment with Bill Pay

- Bill Pay Reminders & Alerts

- Bill Pay eBill

- What is the $5 Membership?

- Security Alerts

- Secure Email

- Card Controls

- Principal Only Payments

- Accessing the Bill Pay Legacy Site

- Financial Tools

- Redeeming Your GreenState Credit Card Points

- Contact Us

- Online Chat Support

- Staff Directory

- Fraud Prevention

- For Employers

- ¡Bienvenidos!

- Creating Lasting Value

- Personal Accounts

- Business Accounts

- Account Management

- Loans

- Credit Cards

- Business Loans & Services

- Wealth Management

- Trust Services

- Insurance

- Locations

- Contact & Support

- Creating Lasting Value

NCUA Insurance

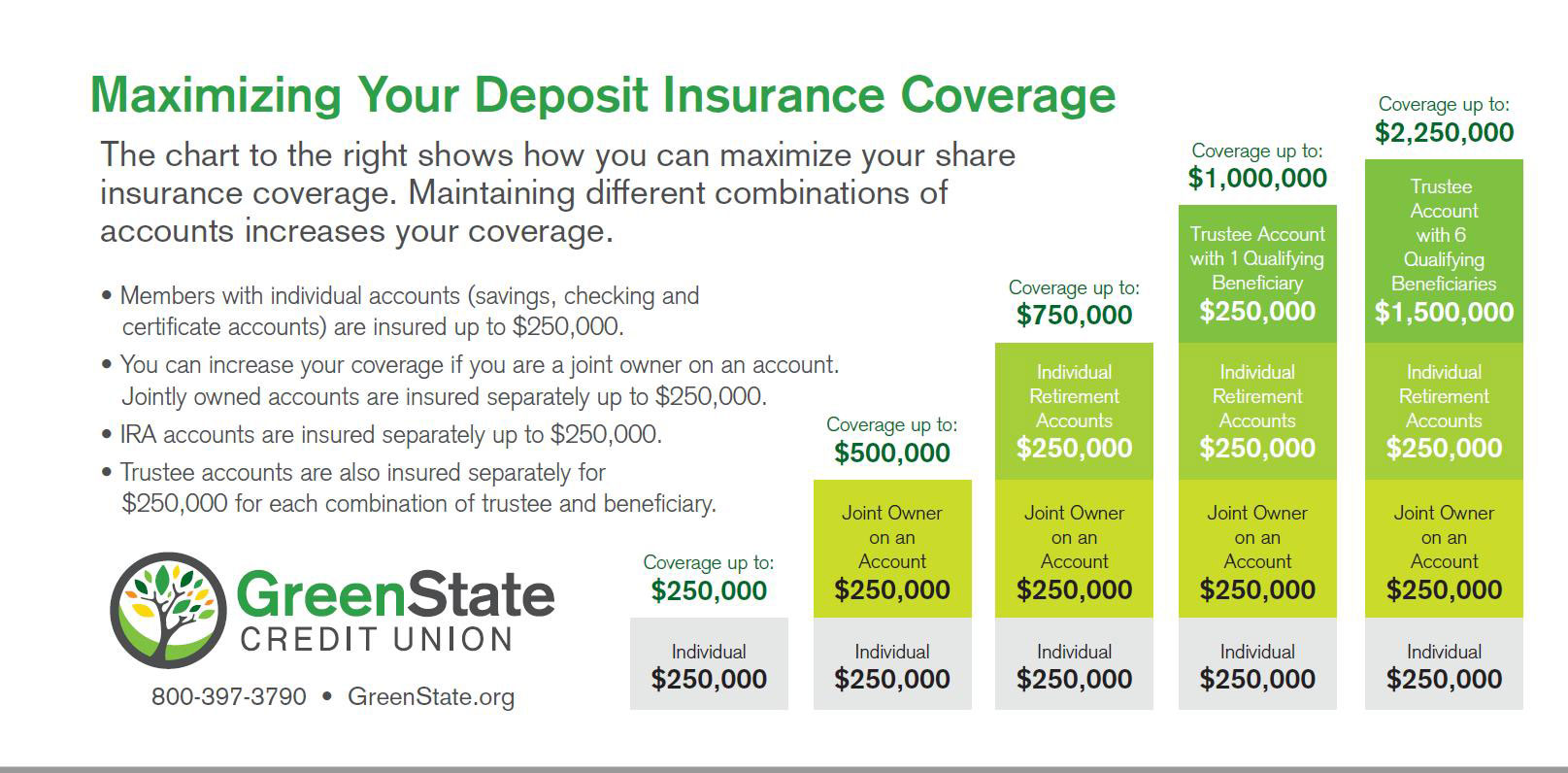

GreenState Credit Union is federally insured by the National Credit Union Administration (NCUA), a government agency. Your deposits are federally insured to at least $250,000 and backed by the full faith and credit of the United States Government.

The NCUA share insurance fund serves the same purpose for federally insured credit unions as the FDIC fund serves for federally insured banks.

Share Insurance Fund Overview

The National Credit Union Share Insurance Fund was created by Congress in 1970 to insure members' deposits in federally insured credit unions. Each credit union member has at least $250,000 in total coverage. Administered by the NCUA, the Share Insurance Fund insures individual accounts up to $250,000. Additionally, a member’s interest in all joint accounts combined is insured up to $250,000. The Share Insurance Fund also separately protects members’ IRA and KEOGH retirement accounts up to $250,000 and provides additional coverage for members’ trust accounts. The Share Insurance Fund has the backing of the full faith and credit of the United States. Credit union members have never lost even a penny of insured savings at a federally insured credit union.

If you’d like further details, you can learn more at the NCUA website: www.ncua.gov

Use the NCUA provided Share Insurance Estimator to calculate the insurance coverage of all types of share accounts offered by a federally insured credit union.

Contact & Support

- Getting Started

-

Help Center

- Online Travel Notification

- Mailing Addresses

- Online Banking Balance & Activity Alerts

- Making a payment with Bill Pay

- Bill Pay Reminders & Alerts

- Bill Pay eBill

- What is the $5 Membership?

- Security Alerts

- Secure Email

- Card Controls

- Principal Only Payments

- Accessing the Bill Pay Legacy Site

- Financial Tools

- Redeeming Your GreenState Credit Card Points

- Contact Us

- Online Chat Support

- Staff Directory

- Fraud Prevention

- For Employers

- ¡Bienvenidos!